Homework 2: Example Analysis

[For your analysis, please also include citations of other papers that have analyzed these data]

[Data download URL]

Suppose here we set out to analyze the predicability (forecast) of stock prices based on the company's industry, (e.g. technology, science, automotive, industrial, utilities). Then, once we've created a forecasting model that performs reasonable well, we would like to create a theoretical portfolio with minimal variance. That is, by creating a portfolio of stocks that minimizes the overall variance based on the weighted average of each individual asset's variance.

First, we explore the basic properties of the entries in the dataset in order to begin to refine our analysis. Once we understand how our data is formatted and what the data range is for each variable, we investigate the relationship between 10 stocks at a deeper level.

Project goals:

(1) Forecast prices based on similarly behaving stocks (cluster analysis)

(2) Create minimum variance portfolio (optimization)

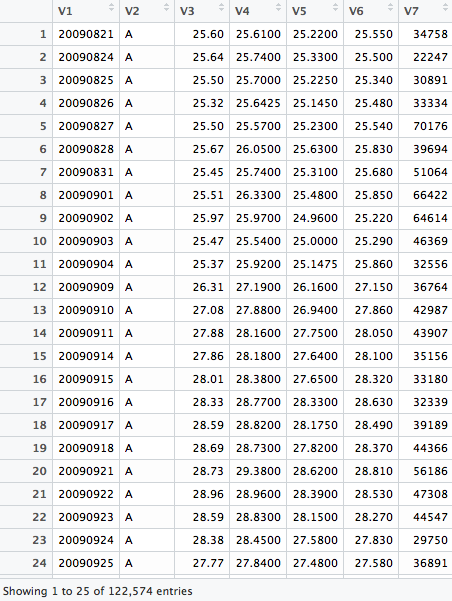

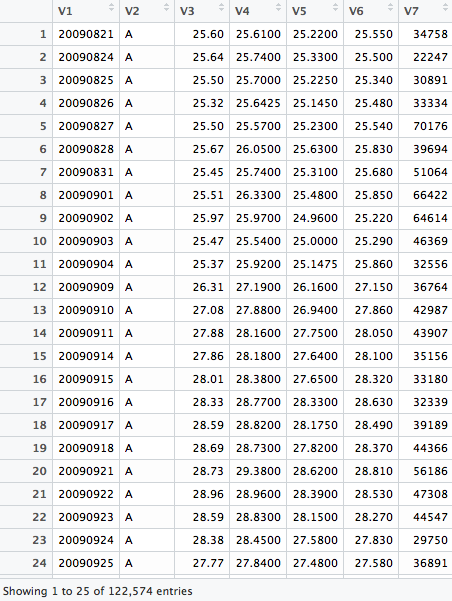

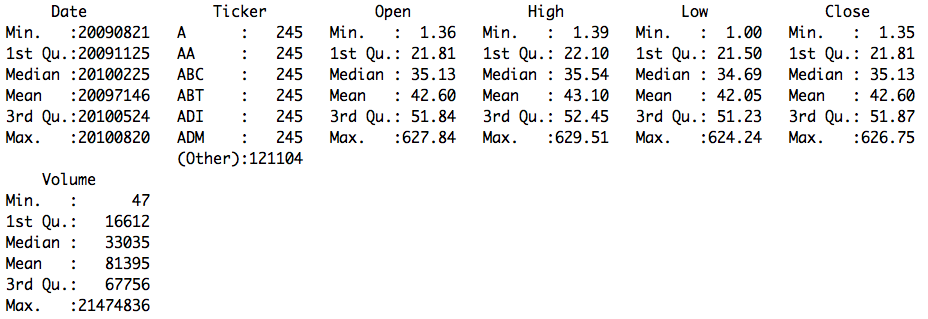

Data description: There are 524 unique ticker names (stocks) represented in this dataset. The dataset contains historical prices from the start of 2009 to the end of 2010, but only a sparse set of 245 days in that range. There are 252 trading days in a year, meaning our dataset contains about 1-year of trading spread across 2 years. For each ticker and each date, the dataset has information on the opening price and closing price, as well as the high and low for that day. In addition, we have the trading volume for each stock each day (the total number of shares involved in transactions). There is no missing data in this dataset.

library(ggplot2)

library(dplyr)

library(tidyr)

library(lattice)

sp500hst <- read.csv("~/Downloads/sp500hst.txt", header=FALSE) # read data

sp500hst <- as.data.frame(sp500hst) # convert to dataframe

colnames(sp500hst) <- c("Date", "Ticker", "Open", "High", "Low", "Close", "Volume") # name columns

sp500hst$Date <- as.numeric(sp500hst$Date) # convert date to number

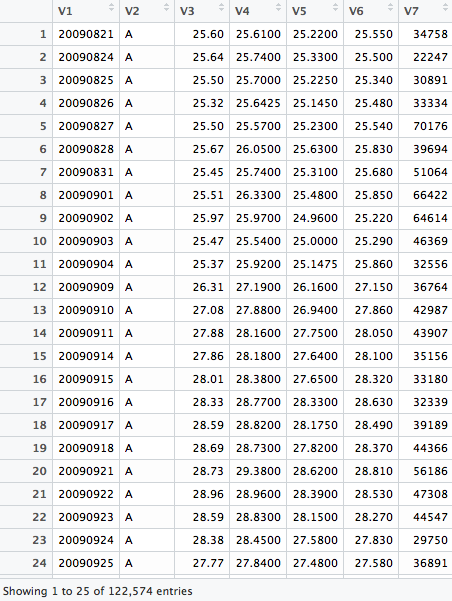

What does the raw data look like right after reading it into R?

First analysis: a summary of the data

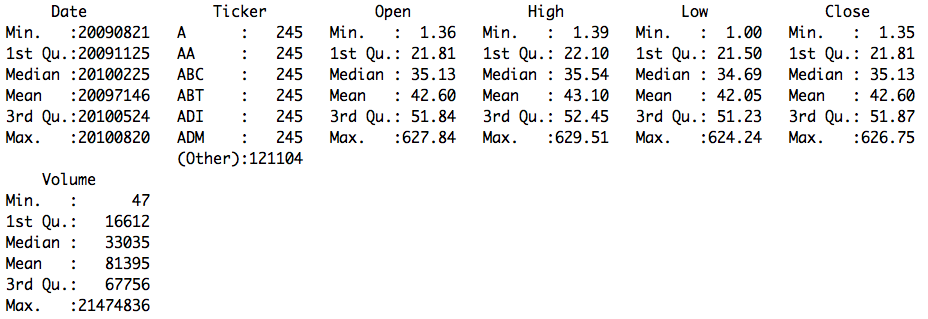

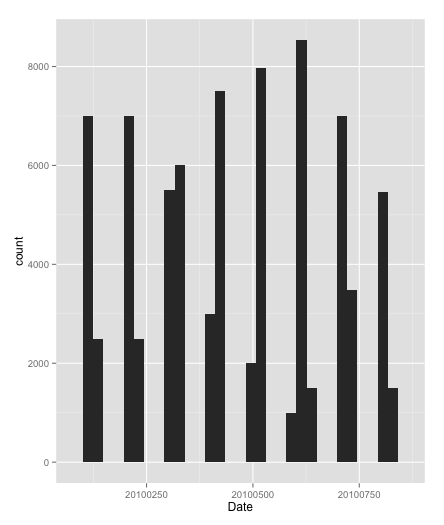

ggplot(sp500hst,aes(x=Date)) + geom_histogram() # plot histogram of dates

Histogram of dates in the dataset

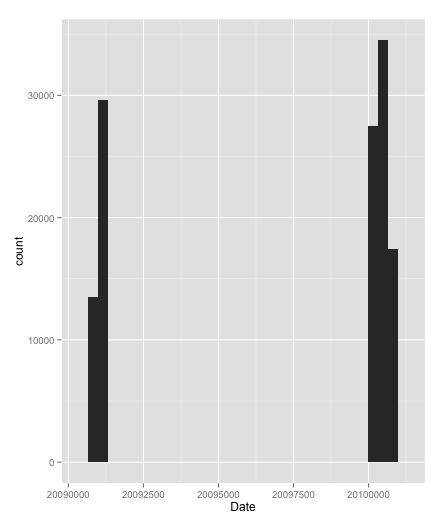

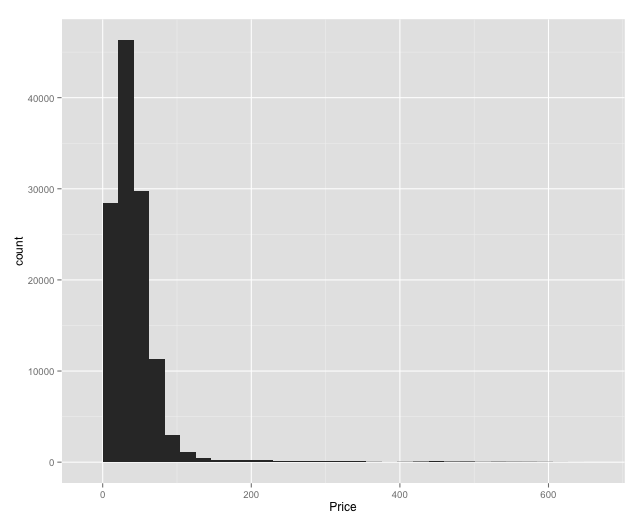

sp500hst_filtered <- sp500hst %>% filter(Date > 20091231) # take only dates in 2010

ggplot(sp500hst_filtered,aes(x=Date)) + geom_histogram() # check that the filter worked

Histogram of dates after filtering for 2010

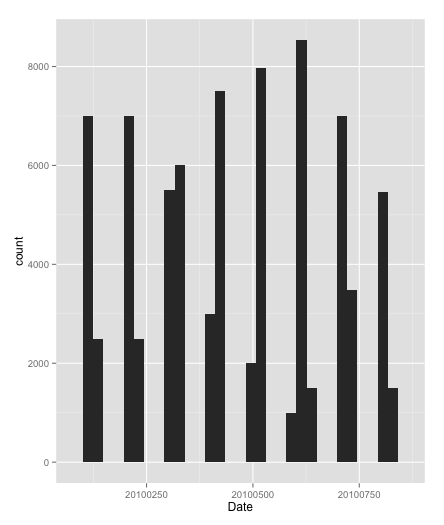

sp500hst_filtered <- sp500hst_filtered %>% gather(Type,Price,-Date,-Ticker,-Volume) # gather all prices in one column

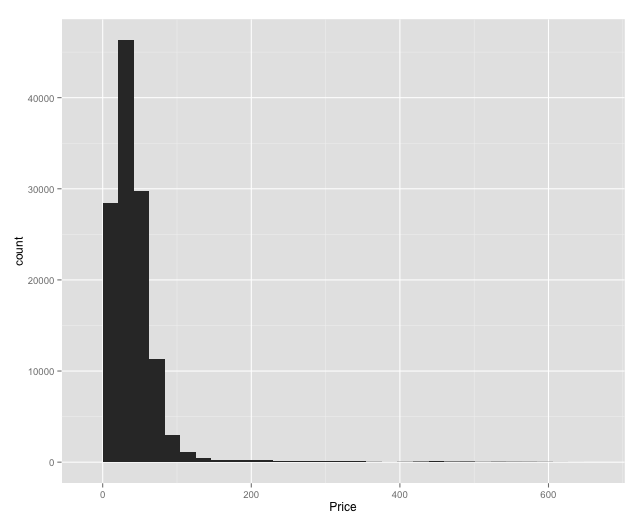

ggplot(sp500hst_filtered[sp500hst_filtered$Type=="Open",],aes(x=Price)) + geom_histogram()

Histogram of opening prices

top10 <- head(unique(sp500hst_filtered$Ticker),10)

sptop10 <- sp500hst_filtered %>% filter(Ticker %in% top10) # get top 10 tickers (alphabetically)

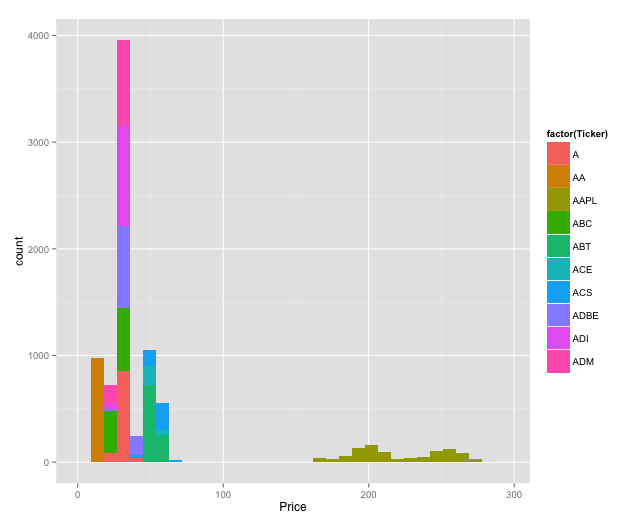

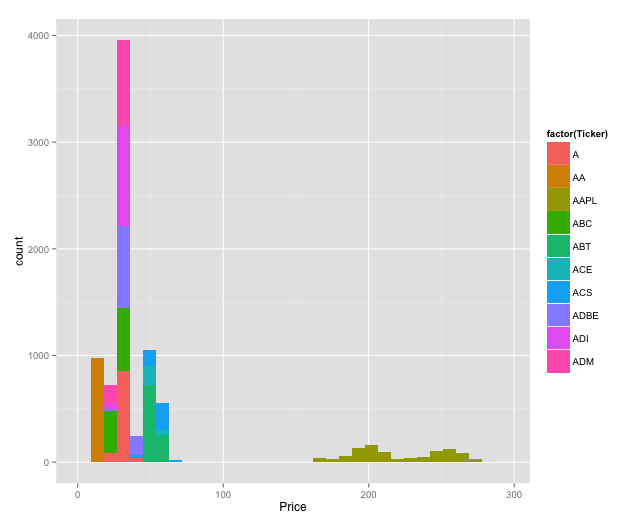

ggplot(sptop10[sp500hst_filtered$Type=="Open",],aes(x=Price,fill=factor(Ticker))) + geom_bar()

Histogram of opening prices colored by ticker

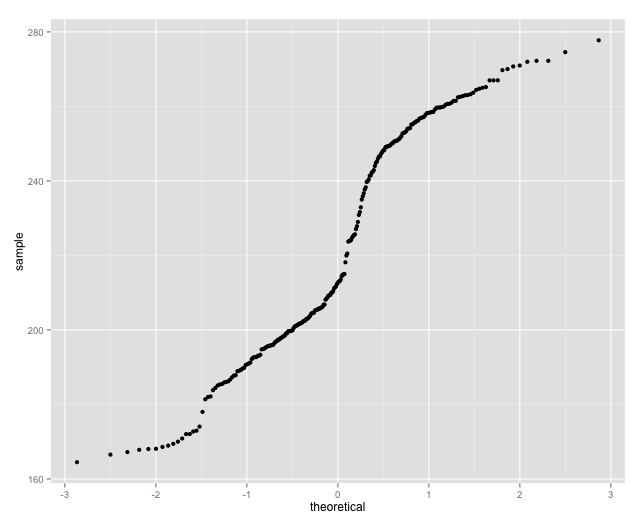

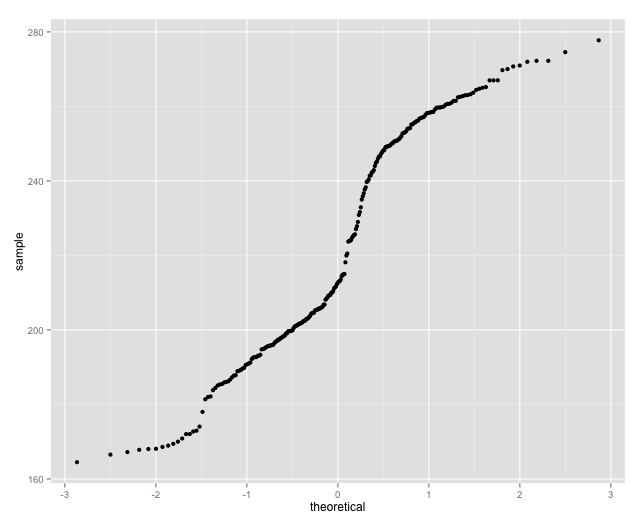

The Apple prices don't look normally distributed, let's check the Q-Q plot.

qplot(sample = sptop10[sptop10$Ticker == "AAPL" & sptop10$Type == "Open",]$Price,stat="qq")

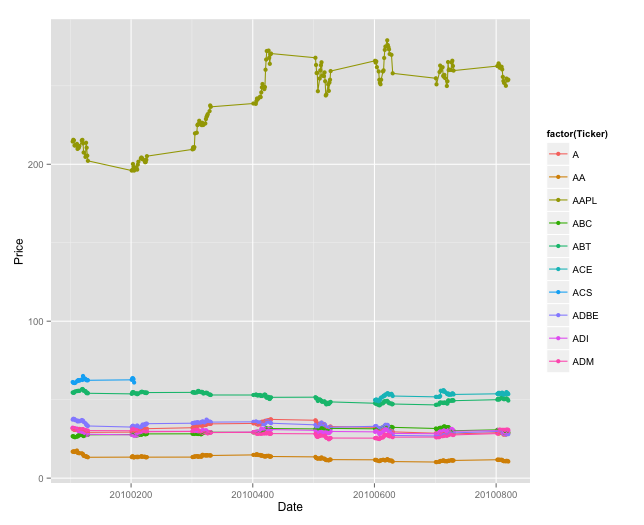

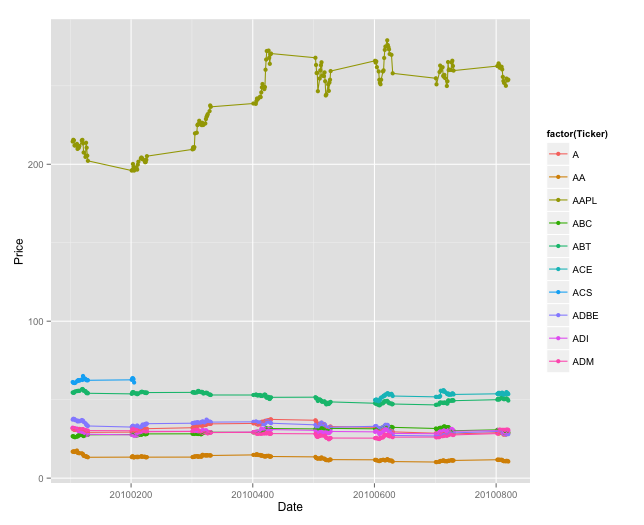

Daily high for each stock

ggplot(sptop10[sptop10$Type == "High",],aes(x=Date,y=Price,color=factor(Ticker))) + geom_point() + geom_line()

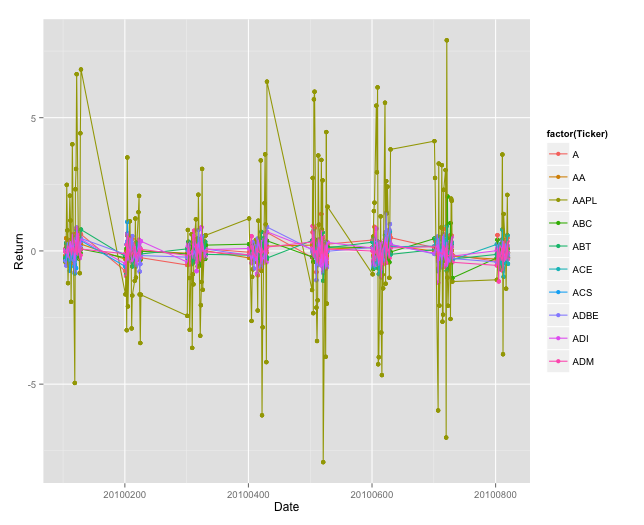

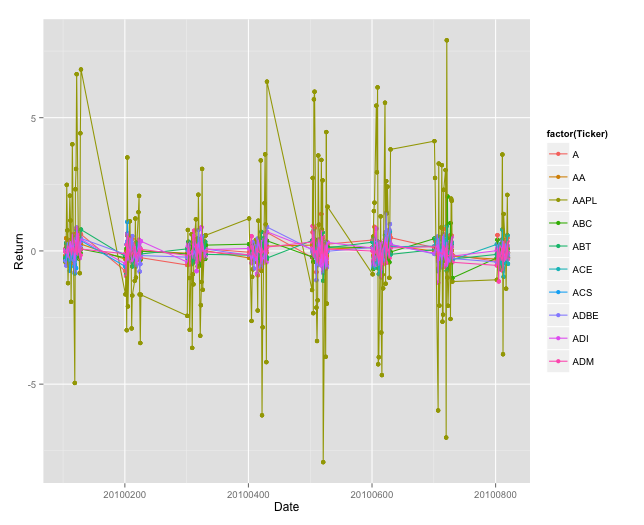

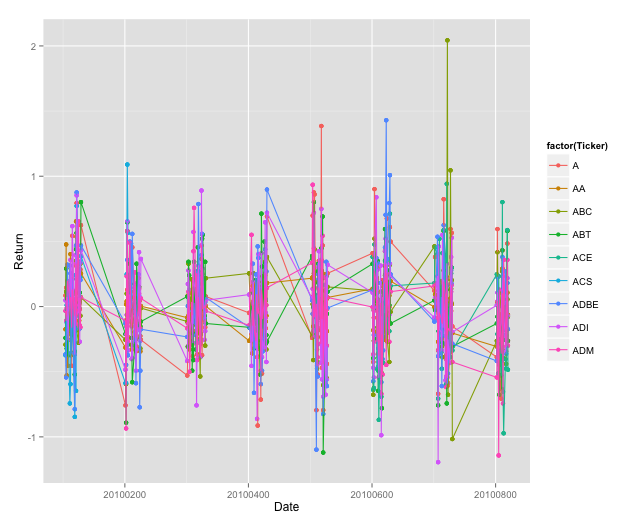

Daily return Z-scores

sptop10$Return <- sptop10[sptop10$Type=="Open",]$Price-sptop10[sptop10$Type=="Close",]$Price

sptop10$Return <- (sptop10$Return-mean(sptop10$Return))/sd(sptop10$Return)

ggplot(sptop10,aes(x=Date,y=Return,color=factor(Ticker))) + geom_point() + geom_line()

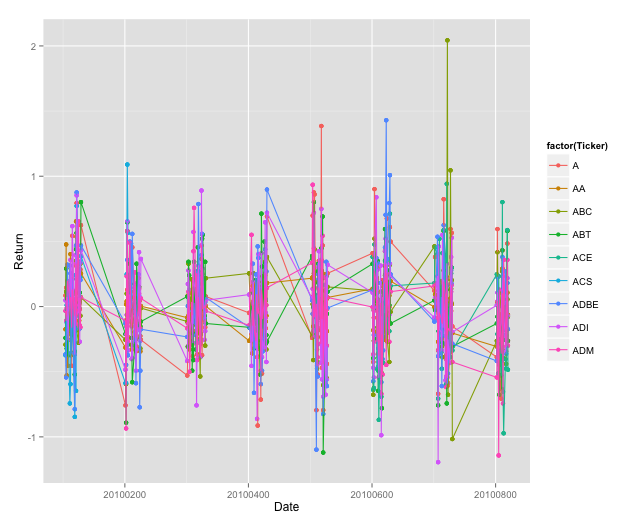

Daily returns without Apple included

ggplot(sptop10[sptop10$Ticker != "AAPL",],aes(x=Date,y=Return,color=factor(Ticker))) + geom_point() + geom_line()

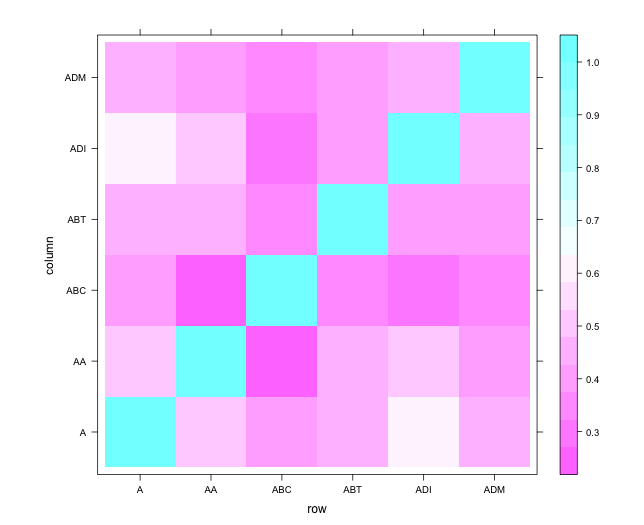

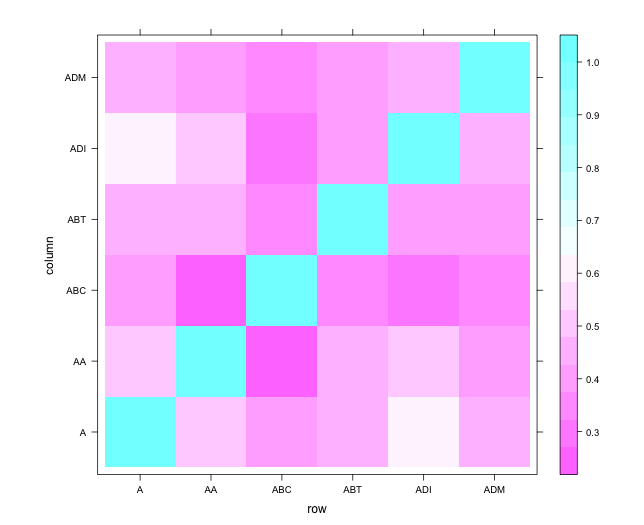

Correlations of daily returns of 6 stocks with full data

max_entries = max(sapply(unique(sptop10$Ticker),function (x) length(sptop10[sptop10$Ticker==x,]$Return)))

stocks <- c()

ret_matrix <- c()

for(stock in unique(sptop10$Ticker)){

if(length(sptop10[sptop10$Ticker==stock,]$Return) == max_entries){

ret_matrix <- cbind(ret_matrix,sptop10[sptop10$Ticker==stock,]$Return)

stocks <- c(stocks,stock)

}}

return_correlations <- cor(ret_matrix)

colnames(return_correlations) <- stocks

rownames(return_correlations) <- stocks

levelplot(return_correlations)

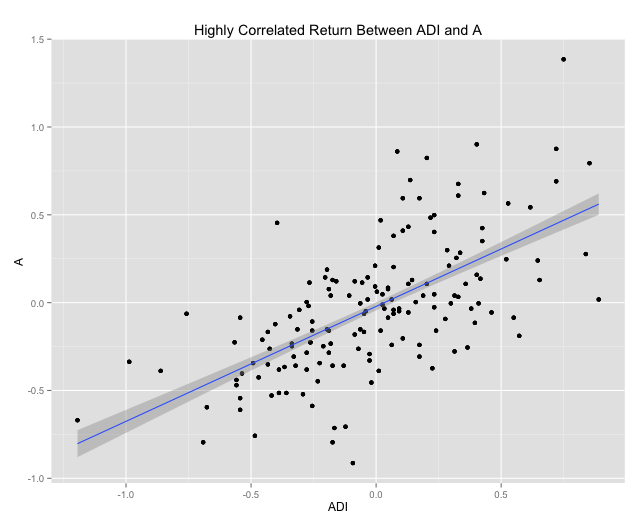

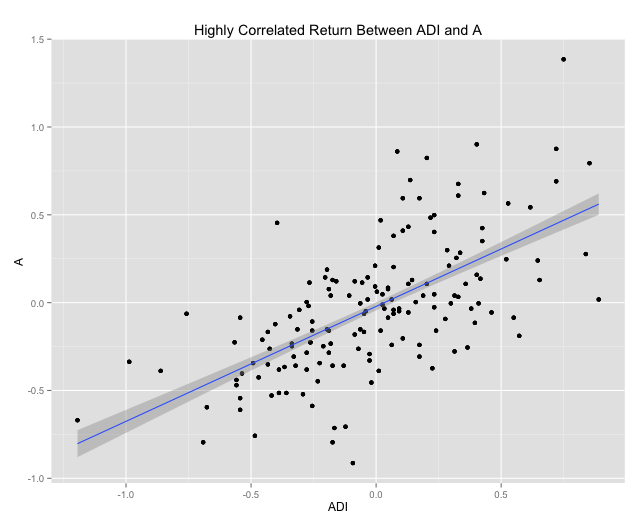

Highest correlated return of two stocks

high_corr <- as.data.frame(list(x=sptop10[sptop10$Ticker == "ADI",]$Return,y=sptop10[sptop10$Ticker == "A",]$Return))

ggplot(high_corr,aes(x=x,y=y)) + geom_point() + geom_smooth(method="lm",se=TRUE) + xlab("ADI") + ylab("A") + ggtitle("Highly Correlated Return Between ADI and A")

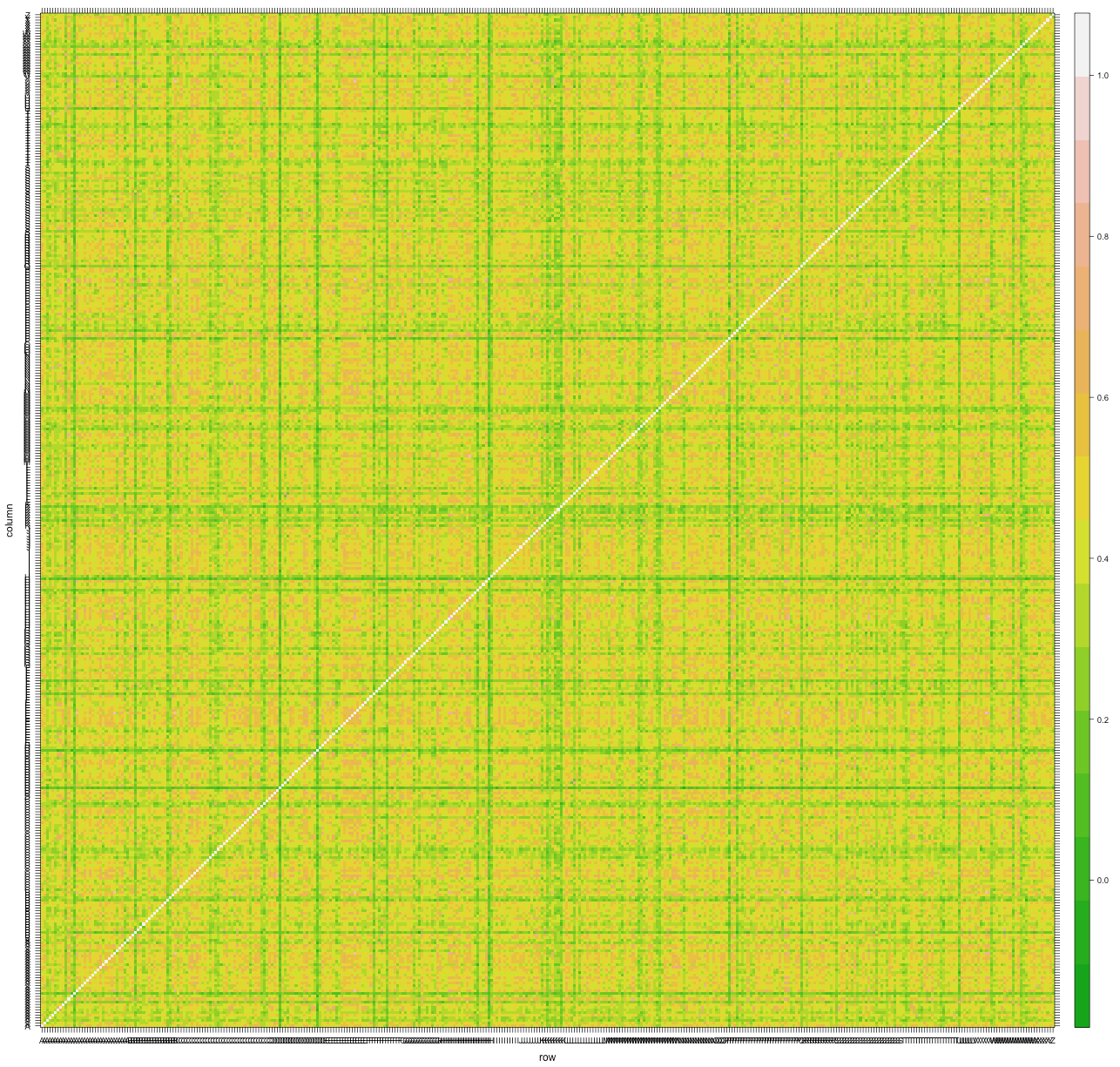

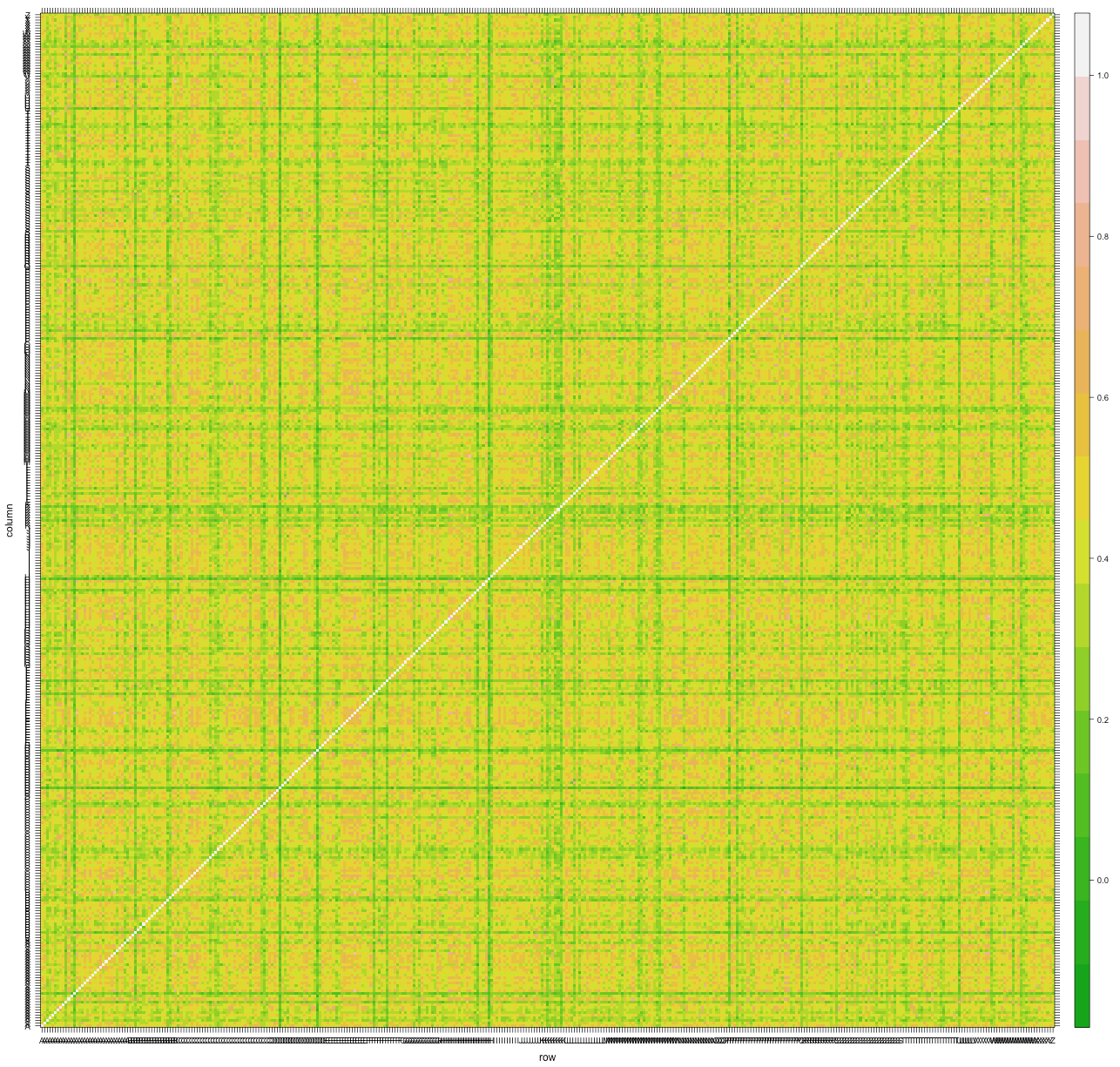

Correlations of daily returns of all stocks with full data

There are some interesting trends to explore deeper here. First, there appears to be some stocks that are not correlated at all with any others. Other stocks that are correlated appear to be clustered in blocks. After clustering the stocks in order to enforce some ordering, we might see more interesting block structure.

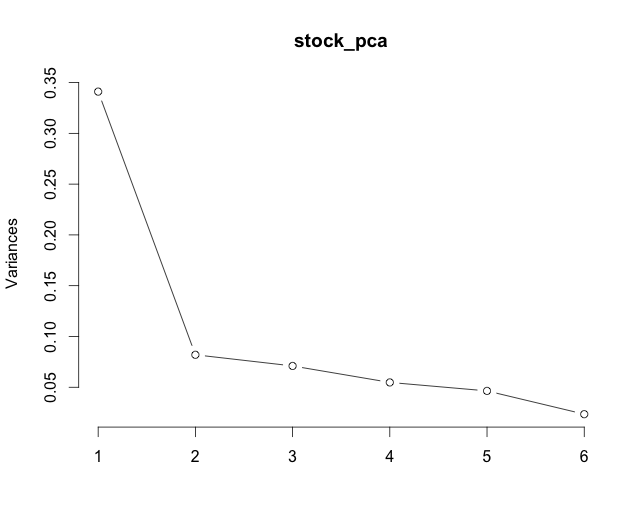

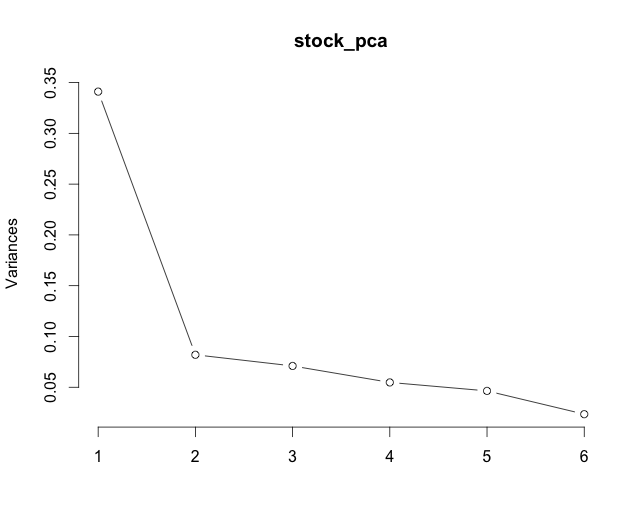

PCA and variance explained by PCs

stock_pca <- prcomp(ret_matrix)

plot(stock_pca, type = "l")

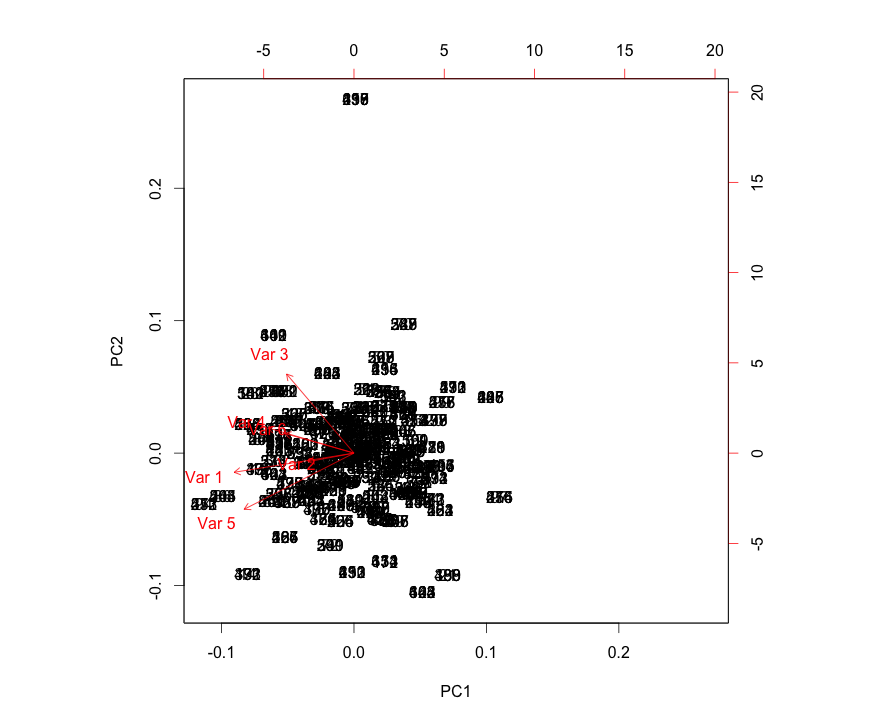

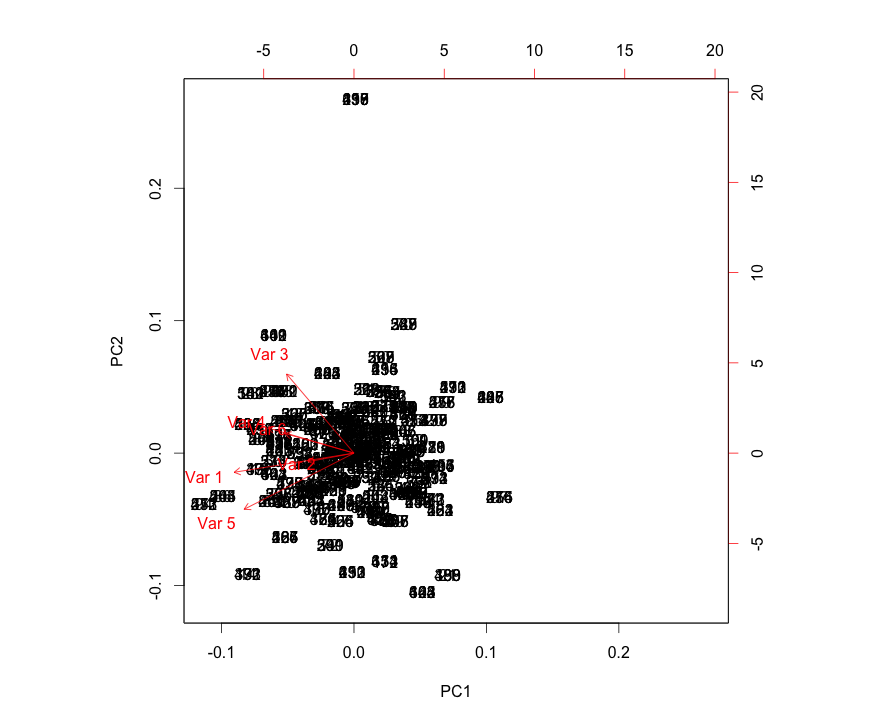

Variables (stocks) on PC loadings

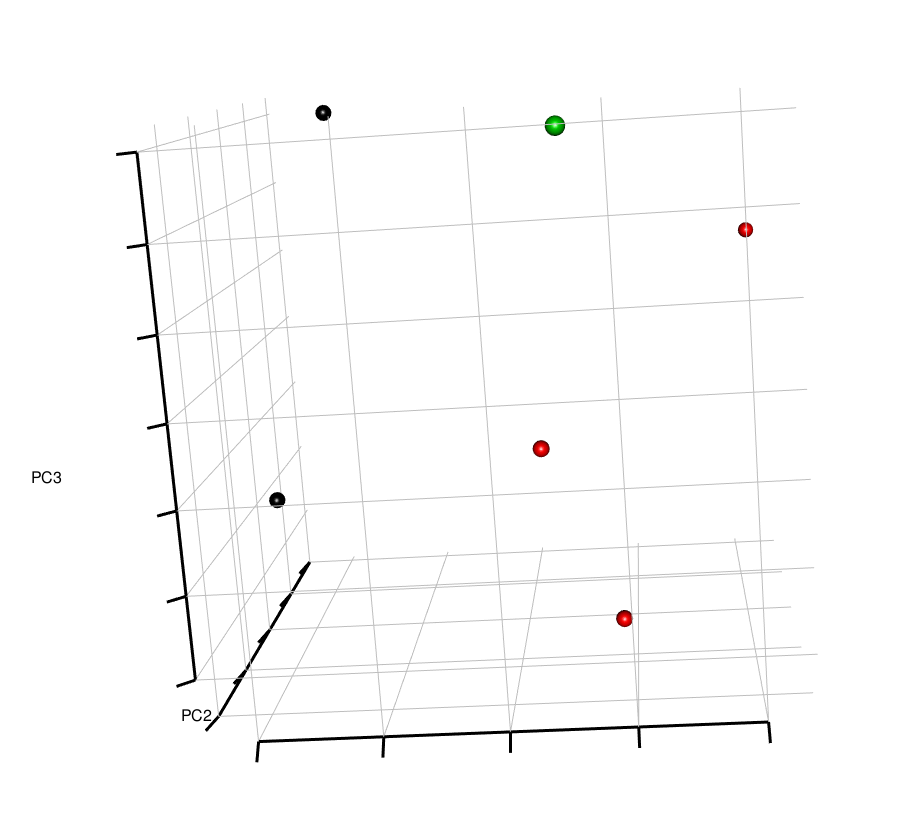

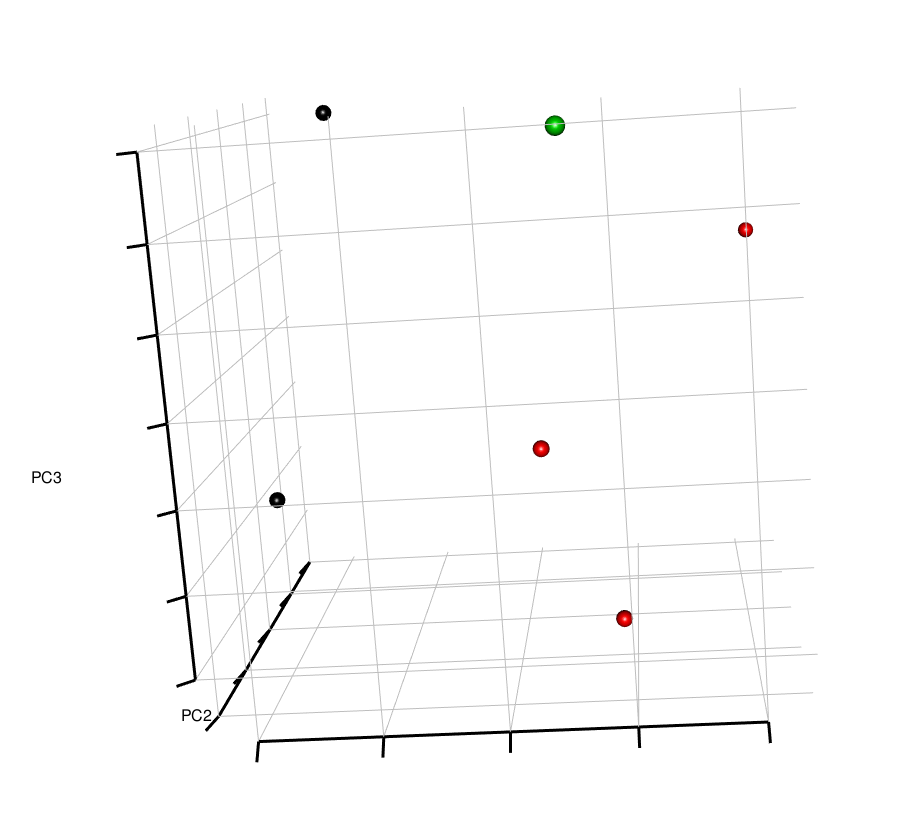

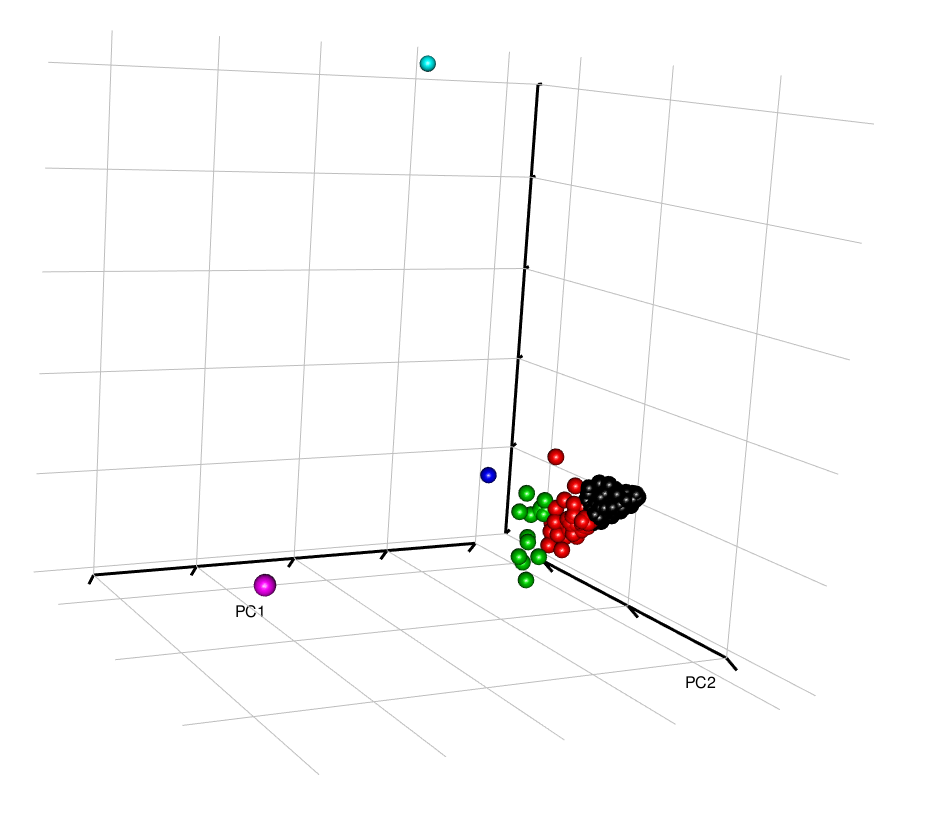

3D PCA Plot of variables

stock_pca <- prcomp(t(ret_matrix))

plotPCA(stock_pca$x[,1:3],6)

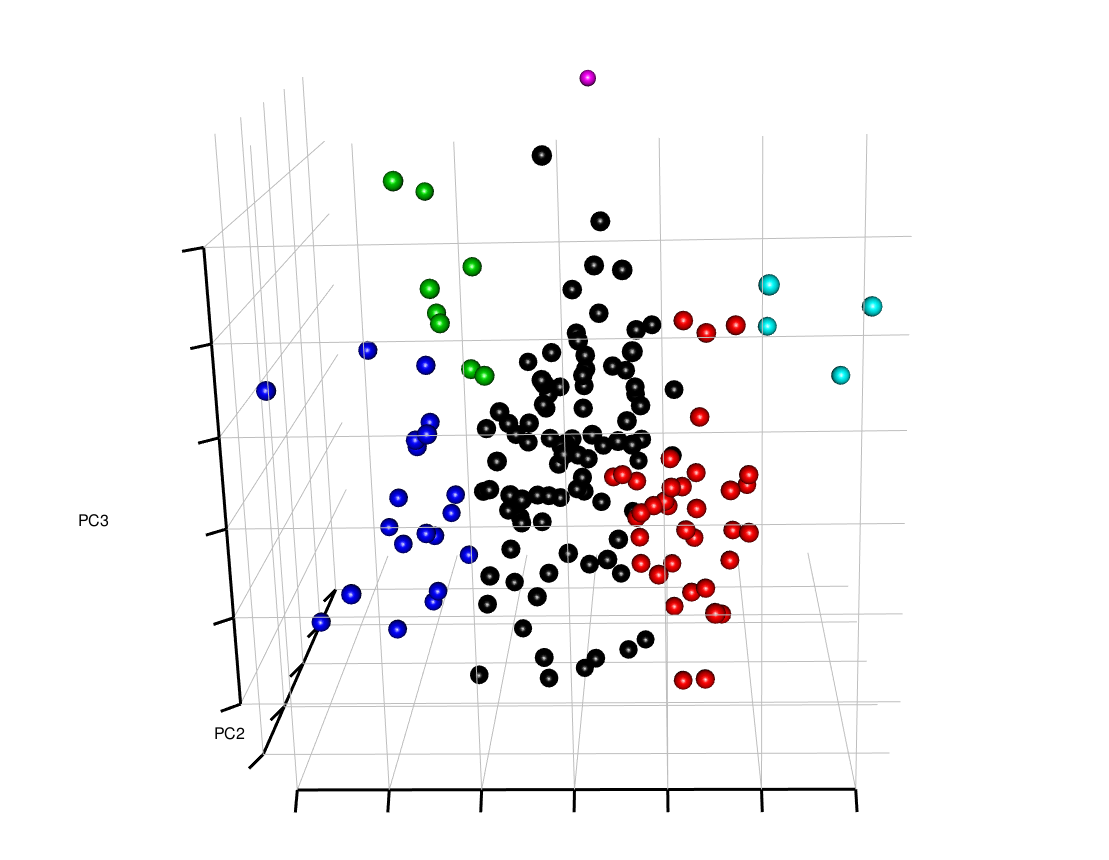

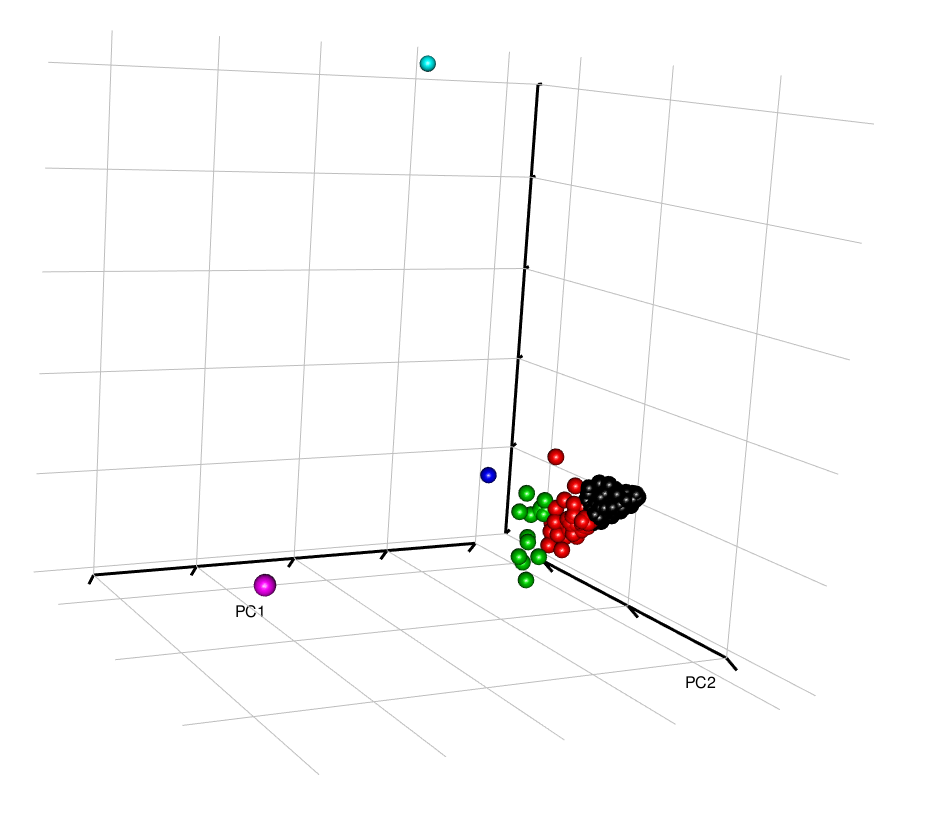

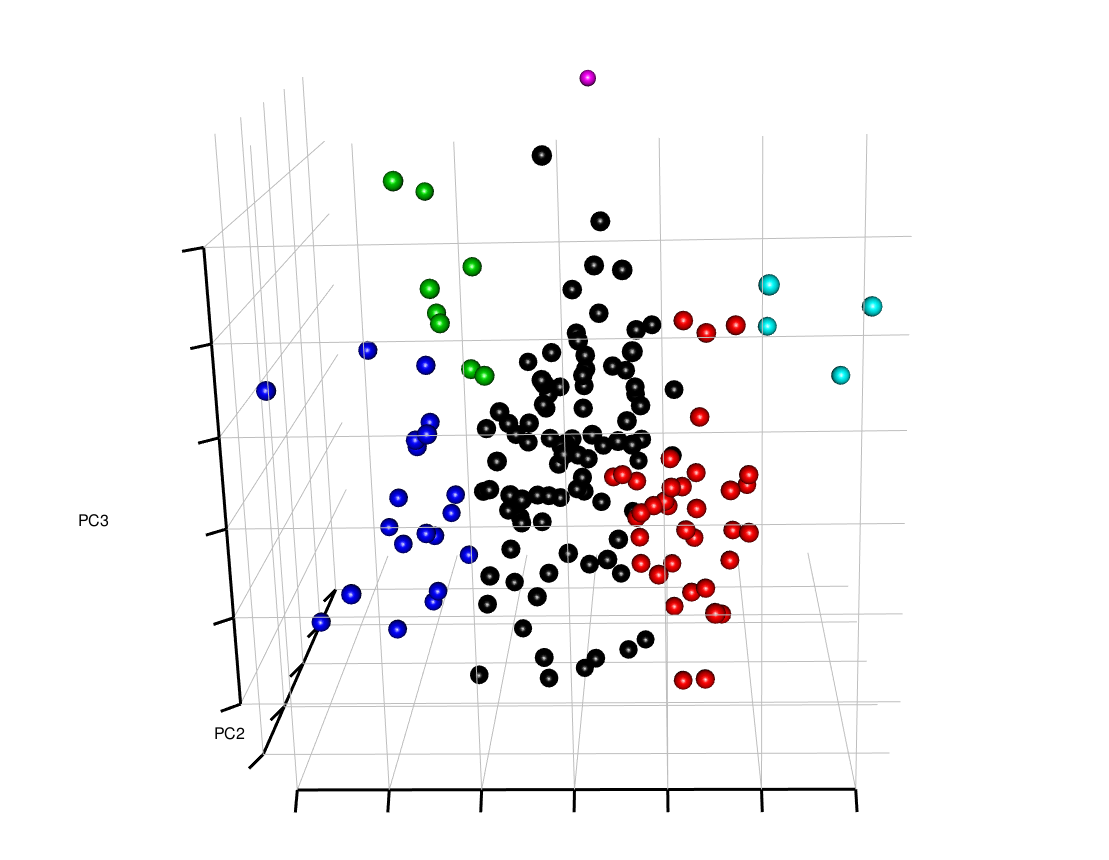

3D PCA Plot of samples

plotPCA(stock_pca$x[,1:3],6)

(credit: http://stackoverflow.com/questions/24282143/pca-multiplot-in-r)

3D PCA Plot of all variables (stocks)

stock_pca <- prcomp(t(ret_matrix))

plotPCA(stock_pca$x[,1:3],6)

Interestingly, here, the all the stocks seem to cluster together, except for a few outliers. It would be good to identify these to understand whether these outliers are a result of data input error, or whether these stocks do display highly different behavior than the rest.